Singapore-based United Overseas Bank (UOB), has launched a new digital banking solution to allow its corporate clients manage their banking requirements in a smarter and personalised way.

With the digital banking service, UOB Infinity, the bank’s clients can manage both domestic and cross-border banking activities which range from checking their accounts across several markets and in making local and international payments, without logging into several accounts.

The service also features real-time payment receipt confirmation at the beneficiary bank, which can also help address the challenges that corporate treasurers usually face, by improving transparency and certainty of payment.

UOB Infinity features a biometric login via a soft token on the mobile app, allowing clients avail faster access and simplified transaction authorisation while offering better safety.

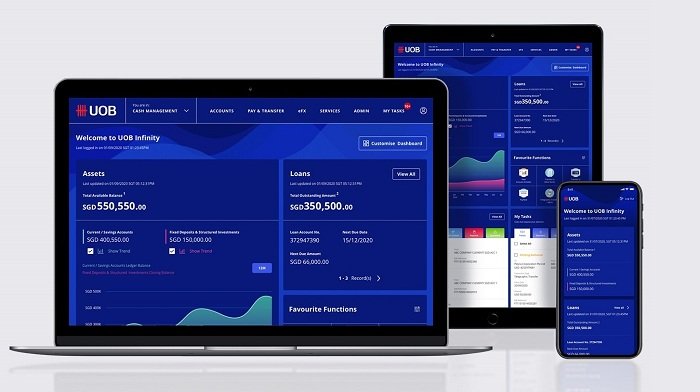

UOB Infinity’s dashboard lets clients check the state of the company in real-time

UOB Infinity offers a customisable dashboard that lets clients to prioritise and display important information. The dashboard also offers financial information visually, also making it easier for them to see the state of their organisation at a glance and in real-time.

UOB, group transaction banking, group wholesale banking head So Lay Hua said: “The launch of UOB Infinity is another example of our commitment to developing digital solutions that enable our clients to bank more easily and conveniently. “We believe that through UOB Infinity’s simple and user-friendly interface, breadth of functionalities and personalised experience, we will be able to help more of our clients increase their use of digital banking services for better productivity and business performance.

“Not only is this essential to supporting businesses in their digital transformation efforts, it also helps in increasing their resilience and ability to make timely, data driven decisions to cope with unexpected events such as the COVID-19 pandemic.”

The Singapore-based bank claims that some of its clients had piloted UOB Infinity and found it to be easy to use, where its rich features had enhanced not only the experience, but also productivity and business performance.