Managing money, sticking to a budget and even handling investment decisions are easier than ever before with today’s crop of personal finance apps.

But not every tool out there is actually worth downloading and learning to use. You can take some of the guesswork out of moving your finances to mobile with this list of the best personal finance apps for 2018.

1. Mint: Best app for managing your money

Hands down, the free Mint app from Intuit Inc. (INTU) – the name behind QuickBooks and TurboTax – is an effective all-in-one resource for creating a budget, tracking your spending and getting smart about your money. You can connect all your bank and credit card accounts, as well as all your monthly bills, so all your finances are in one convenient place – no more logging in to multiple sites.

Mint lets you know when bills are due, what you owe and what you can pay. The app can also send you payment reminders so you can avoid late fees. Based on your spending habits, Mint even gives you specific advice to gain more control over your budget. The free credit score is a nice bonus, too.

Special features: Shows your real-time credit score

This app is for you if: You want to know how much money you have at any given time across multiple accounts and cards.

2. You Need a Budget: Best app for getting out of debt

2. You Need a Budget: Best app for getting out of debt

You Need a Budget (YNAB to enthusiasts) is unlike any other budgeting app you’ve used before. YNAB helps you stop living paycheck to paycheck, pay down debt and “roll with the punches” if something unexpected comes up. It’s built around a fairly simple principle – every dollar has a job.

You Need a Budget doesn’t let you create budgets around money you don’t have – it forces you to live within your actual income. If you get off track (and who doesn’t occasionally?), YNAB helps you see what you need to do differently to balance your budget. The built-in “accountability partner” keeps you on your toes. Although users pay a small monthly or annual fee for YNAB, the service and support are worth it. Online classes with a live instructor for Q&A to help you learn budgeting basics are included. In fact, YNAB is so effective that the average user pays off $500 in debt the first month.

Special features: Not only can you set up weekly/monthly budgets (all personal finance apps do that!) but you can also set up budgets or individual projects, like “Christmas gifts 2018.”

This app is for you if: Every other attempt you’ve made to get your budget in check has left you frustrated and hopeless.

3. Wally: Best app for tracking expenses

If you’re the sort of person who’d love to be as organized with personal expense tracking as you are with your expense reports at work, you’ll love the totally free Wally app. Instead of manually logging your expenses at the end of the day (or week or month), Wally lets you simply take a photo of your receipts. And if you use geo-location on your device, it even fills in that info, saving you several steps.

Wally is a clean, streamlined app that’s extremely convenient and easy to use. It’s a great choice if you’d like more insight into where your money is going.

Special features: You can take a photo of your receipts instead of manually entering numbers. Less typing=less fat-fingering errors.

This app is for you if: Your previous attempts to track expenses were abandoned within a month because you hated typing stuff.

4. Acorns: Best app for painless saving

Want to harness the benefits of automating good financial behavior? If that sounds complicated, the Acorns app decidedly isn’t. Basically, every time you make a purchase with a card connected to the app, Acorns rounds it up to the next highest dollar and automatically invests the difference in a portfolio of low-cost exchange-traded funds (ETFs) that you select based on your risk preference.

Acorns puts your pocket change to work in an utterly painless way – users say that they never even notice the difference. Wouldn’t you love to find an extra $300 or $500 or even $1,500 in your investment account each year? The service is free to college students and charges just $1 per month for pretty much everyone else.

Special features: You can set up your Acorn app to automatically invest your savings without your even knowing about it

This app is for you if: You have never owned a share of stock because you thought you didn’t have enough money to invest.

5. Coinbase: Best app for trading Cryptocurrency

5. Coinbase: Best app for trading Cryptocurrency

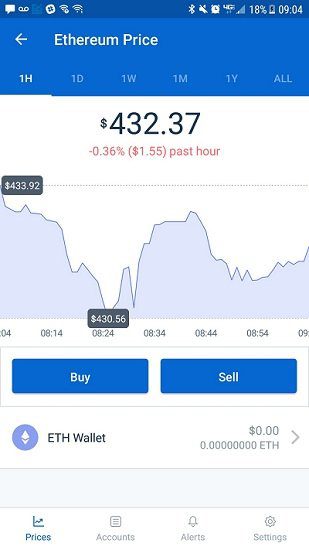

If you only want one app for trading cryptocurrency, Coinbase is a good start. With Coinbase you can trade Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, and Litecoin, however, the digital currency exchange plans to add further assets to their platform in the near future. The app is a stripped down version of the desktop version. If you’re worried about ease of use, the app might be even better for some people than the desktop version, due to the simple interface.

As with the desktop version, purchase limits are capped at $9500 per month for the first-tier user. You can raise that cap to $25,000 if you are willing to provide additional proof of identification, by uploading your passport or other personal documents.

Special features: You can set up price alerts in advance so that you know when your target sell/buy price has been met.

This app is for you if: You want to get started buying and selling bitcoin, or sending it to friends.

6. Robinhood: Best investing app for the 99%

Robinhood is a game-changing investing app with a very unique and unbeatable feature: transactions are free. (They make money by upselling premium services like margin trading). It’s also one of the very first personal investing apps to offer Bitcoin trading capabilities. Founded by Vlad Tenev and Baiju Bhatt – former roommates at Stanford University – the app is something of a Cinderella story. They were turned down by 75 VC investors before finally securing funding.

Special features: “Cards” appear on your screen to give you real-time news alerts and market information. They sound intrusive but they’re actually helpful, and you can customize them or opt out altogether.

This app is for you if: You like free stuff and you’re brand-new to investing.

7. Tycoon: Best app for models (and other freelancers)

Tycoon was founded by supermodel Jess Perez, who modeled for Victoria’s Secret and Sports Illustrated’s famous Swimsuit Edition. Perez noticed that models, as with all freelancers, were often paid very late for their work – sometimes months or even years after the contractually required payment period. Late payments are easy to forget, which makes it that much harder for freelancers to chase after clients who owe them money.

According to Perez, the most common job descriptions for users of her app are photographers, developers, contractors, and models. (See Investopedia’s exclusive interview with CEO and founder Jess Perez)

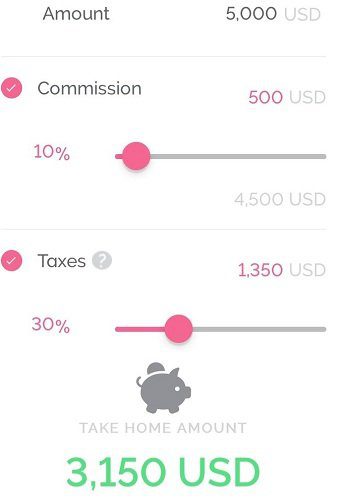

Special features: Tycoon App is catered to a freelancer’s special needs, such as calculating take-home pay minus agent commission, so you can decide whether or not to even accept a gig. It also makes it easy to see at a glance which clients have not paid you yet.

This app is for you if: You want to decide whether it’s worth it for you to take a certain frelance gig. Time, after all, is money.

8. Venmo: Best payment app for splitting the cost of a pizza with friends

Venmo was acquired by Paypal in 2013 for $800 million. The app similar to PayPal, but, in the words of the official site, “is unique in that Venmo allows users to share and like payments and purchases through a social feed. The service is popular with the millennial generation.”

If you want someone to pay you, you send them your personal QR code so they can add you as a recipient. The limit for transactions is $299.99 in a given week. If you set up for authorized merchants payments, your limit for sending funds is $2999.99 weekly.

Special features: If you choose, you can share your transactions with your friends or even the whole Venmo-using world.

This app is for you if: You are the type of person to share your Fitbit running data on your social media feed.

While this list is made up of primarily budgeting apps, if you’re more interested in making investments for your future, Investopedia’s list of best investment apps is where you will find apps that are designed for investing in stocks and other assets.