The Economics of Claims Transformation: Efficiency, Cost Savings, and ROI

The insurance industry has long been defined by its promise of financial protection, yet profitability has often been constrained by one critical function: claims. Claims are the largest expense line for most insurers, representing up to 70% of premiums collected. As competition tightens and customer expectations rise, the economics of claims transformation has shifted from being a back-office priority to a boardroom-level strategy.

Today, insurers are re-engineering claims with digital platforms, automation, and AI. This transformation is not only about faster settlements but also about achieving significant cost savings, reducing fraud, and unlocking long-term return on investment (ROI). In short, claims transformation is redefining insurance economics.

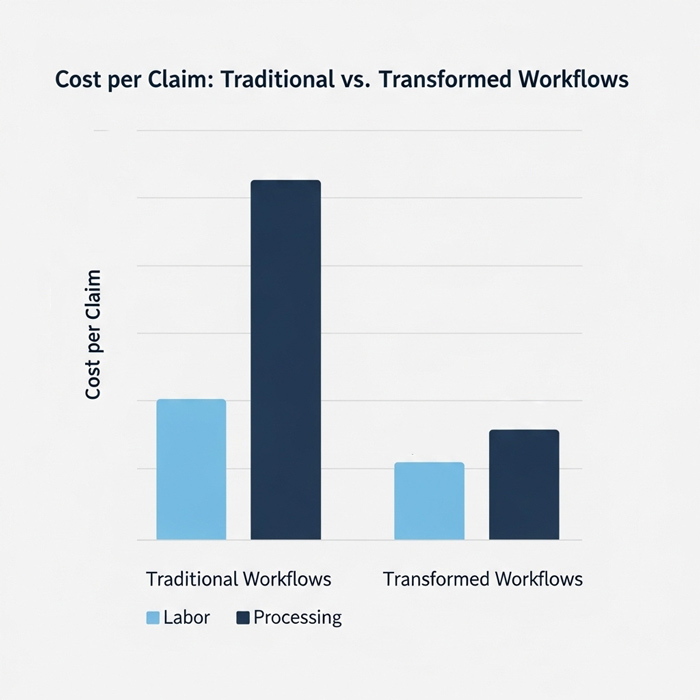

The Cost Burden of Traditional Claims

Legacy claims processes are expensive and inefficient. Paper-based workflows, manual verification, and siloed systems extend cycle times and inflate operational costs.

Industry studies estimate that the average cost per claim can be reduced by 30–40% when modern claims technologies are deployed. Without transformation, however, insurers face:

-

High administrative overheads

-

Prolonged settlement times

-

Customer dissatisfaction leading to churn

-

Elevated exposure to fraud

This cost burden makes transformation not just desirable but essential.

Efficiency Gains Through Automation

Automation is at the core of claims transformation. Straight-through processing (STP) allows certain claims to be settled without human intervention. For example, low-value auto or travel claims can be validated using digital documents, telematics, or receipts, then paid instantly.

This reduces cycle times from weeks to hours, freeing human adjusters to focus on complex cases. The result is both lower operational costs and improved employee productivity.

Robotic process automation (RPA) further enhances efficiency by handling repetitive tasks such as data entry and document verification. Together, these tools transform claims from a cost center into a strategic enabler of customer experience.

Data-Driven Cost Savings

Beyond automation, connected data ecosystems play a major role in driving down claims costs. By integrating policyholder data, IoT inputs, and third-party records, insurers gain real-time visibility into claims.

Consider property insurance: integrating drone imagery and weather data eliminates costly site visits in many cases. In health insurance, linking claims to electronic health records reduces fraudulent or duplicate submissions.

These data-driven approaches not only save money but also improve accuracy, reducing litigation risks and customer disputes.

Measuring ROI of Claims Transformation

Calculating the return on investment from claims transformation requires more than tallying up cost savings. ROI extends across multiple dimensions:

-

Operational Efficiency: Reduced cycle times and administrative expenses.

-

Fraud Reduction: Billions saved annually by preventing fraudulent claims.

-

Customer Retention: Smoother claims journeys increase renewal rates.

-

Brand Reputation: Insurers with modern claims systems attract new customers.

Leading carriers have reported ROI from claims transformation within 18–24 months of deployment, with compounding benefits over time as automation and AI models mature.

The Customer-Centric Value of Transformation

The economic benefits of claims transformation are not purely internal. Faster, more transparent claims build trust and loyalty. Customers who receive instant payouts through digital claims apps are more likely to renew policies and recommend their insurer.

This improved customer experience translates into financial gains through higher Net Promoter Scores (NPS), reduced churn, and cross-selling opportunities. In essence, what is good for the customer is also good for the insurer’s bottom line.

Case Studies of Claims Economics in Action

-

Auto Insurance: A global carrier implementing AI-driven photo estimation reduced average repair cycle time by 50% and saved millions in administrative costs.

-

Health Insurance: An insurer using predictive analytics to flag high-cost claims reduced fraudulent payouts by 25% in the first year.

-

Property Insurance: A European insurer deploying drones for site assessments reported annual savings of €20 million.

These examples demonstrate that claims transformation delivers tangible, measurable economic value.

Challenges in Unlocking ROI

Despite the clear benefits, insurers often struggle to realize full ROI due to:

-

Legacy Systems: Integrating new solutions with old platforms is costly and complex.

-

Change Management: Employees may resist new workflows.

-

Upfront Investment: Significant capital expenditure is required for AI, automation, and data platforms.

However, the long-term benefits far outweigh the challenges. Insurers that delay transformation risk losing competitiveness in both cost and customer satisfaction.

The Future: From Cost Reduction to Value Creation

The next phase of claims transformation will move beyond cost cutting to value creation. Predictive analytics will allow insurers to proactively manage risks, preventing losses before they occur. Personalized claims experiences, powered by AI, will enhance customer engagement.

In the long run, claims transformation will not simply make insurers more efficient — it will redefine how they create value, moving from transactional processing to proactive risk partnerships.

Conclusion

The economics of claims transformation are clear: lower costs, higher efficiency, reduced fraud, and stronger ROI. By embracing automation, connected data, and customer-centric strategies, insurers can turn claims from a cost burden into a competitive advantage.

The insurers who succeed in the coming decade will be those who see claims not as a liability but as a strategic opportunity to unlock both financial and customer value.